What will a change in price do to the amount you need to sell?

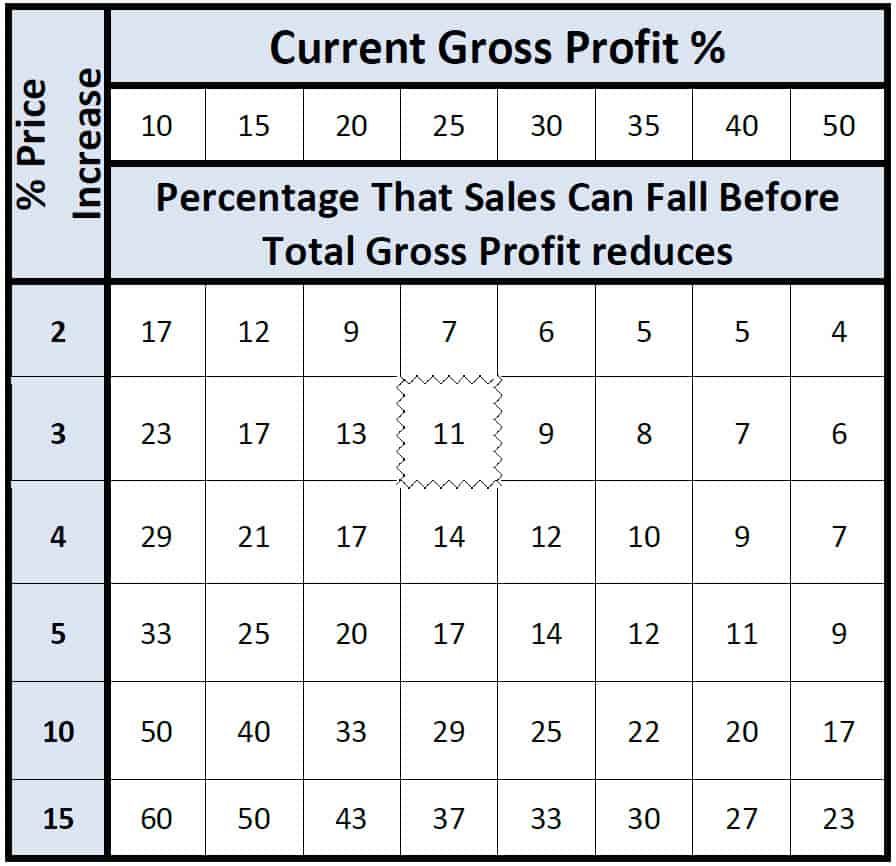

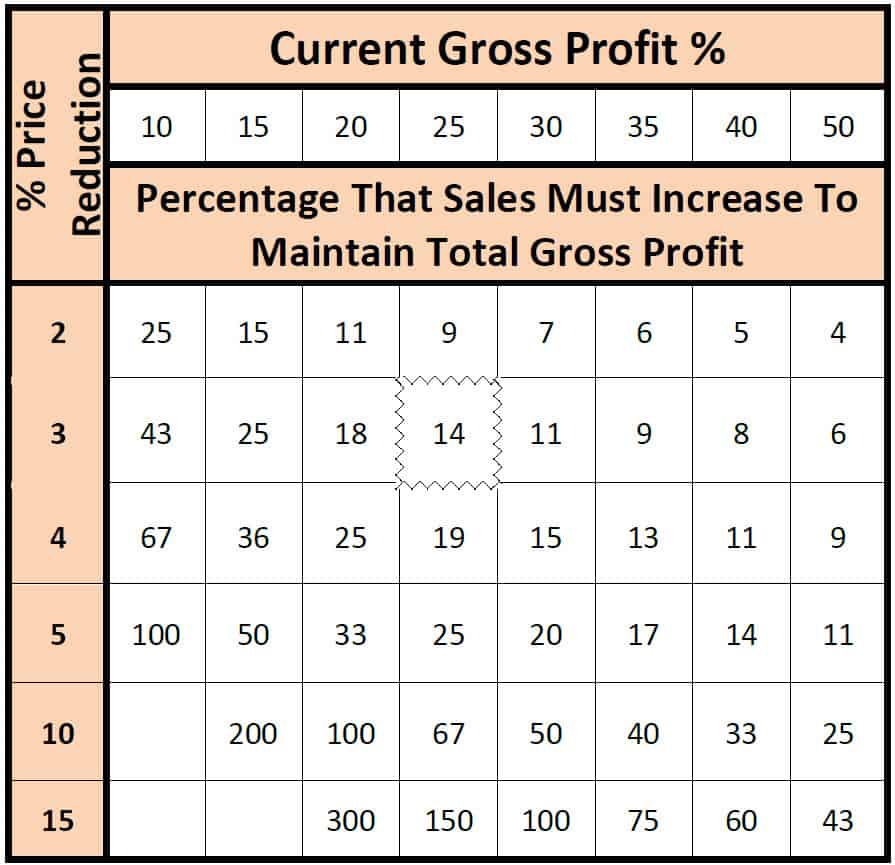

The matrix below showcase the impact of price increase or decrease

Example of Increasing Prices

- Let’s assume your current gross profit is 25

- If you were to increase prices by say 3%

- Sales on that item / service could fall by 11% before gross profit reduces

- So you could potentially lose 1 sale in 10 based on the customer not accepting the price increase and still do as well

Example of Decreasing Prices

- Let’s assume your current gross profit is 25%.

- If you were to decrease prices by say 3%

- Sales on that item / service need to increase by 14% to maintain gross profit

- Are you confident that a 3% price decrease will encourage this volume increase in sales

About Gross Profit Margin

The calculation for Gross profit margin is to subtract cost of goods sold (COGS) from total revenue and then divide that number by total revenue. The top number in the equation, known as gross profit or gross margin, is the total revenue minus the direct costs of producing that good or service

Direct costs (COGS) do not include operating expenses, interest payments and taxes, among other things.

Example of Gross Profit Margin.

- Acme Manufacturing Ltd makes right handed widgets.

- If Acme reported £2 million in total revenue for the year

- If Acme had a total cost of goods sold (cost of materials and direct labor) of £750,000,

- Then we can use the formula to find Acme Manufacturing gross profit margin.

- Acme Manufacturing gross profit percentage = (£2,000,000 – £800,000) / £2,000,000 = 60%

- The gross profit margin percentage tells us that Acme Manufacturing has 60% of its revenues left over after it pays the direct costs associated with making its right handed widgets (its cost of goods sold)

- This gross profit, which equates to £1.2 million in the above example (£2 million in revenues minus £800K in COGS), represents money left over that Company ABC can use for operating expenses, interest, taxes, dividend payouts, etc.

The difference between margin and markup

- Margin is sales minus the cost of goods sold

- For example, if a product sells for £100 and costs £70 to manufacture, its margin is £30. Or, stated as a percentage, the margin percentage is 30% (calculated as the margin divided by sales)

- Markup is the amount by which the cost of a product is increased in order to derive the selling price.

- To use the numbers from the example above, a markup of $30 from the $70 cost yields the $100 price. Or, stated as a percentage, the markup percentage is 42.9% (calculated as the markup amount divided by the product cost).

Mistaking either can cause incorrect pricing

A mistake in the use of these terms can lead to price setting that is substantially too high or low, resulting in lost sales or lost profits, respectively. .

It is easy to see where a person could get into trouble deriving prices if there is confusion about the meaning of margins and markups.

- Essentially, if you want to derive a certain margin, you have to markup a product cost by a percentage greater than the amount of the margin, since the basis for the markup calculation is cost, rather than revenue;

- Since the cost figure should be lower than the revenue figure, the markup percentage must be higher than the margin percentage.

The markup calculation is more likely to result in pricing changes over time than a margin-based price, because the cost upon which the markup figure is based may vary over time; or its calculation may vary, resulting in different costs which therefore lead to different prices.

The differences between the margin and markup percentages at discrete intervals can be seen below

- To arrive at a 10% margin, the markup percentage is 11.1%

- To arrive at a 20% margin, the markup percentage is 25.0%

- To arrive at a 30% margin, the markup percentage is 42.9%

- To arrive at a 40% margin, the markup percentage is 80.0%

- To arrive at a 50% margin, the markup percentage is 100.0%

To derive other markup percentages, the calculation is: Desired margin ÷ Cost of goods = Markup percentage

- For example in the case of Acme manufacturing ,

- if you know that the cost of a product is £700 and you want to earn a margin of £500 on it, the calculation of the markup percentage is:

- £500 Margin ÷ £700 Cost = 71.4%

- If we multiply the £700 cost by 1.714, we arrive at a price of £1200. The difference between the £1200 price and the £700 cost is the desired margin of £500

Price Change Calculator, Margin and Mark Up

For more information on price change calculator and factors that will impact your marketing and sales strategy click here. To talk to Andrew Goode MBA FCIM an experienced business development professional click here